Every year, India loses approximately ₹40,000 crore in property damage due to fire incidents. Between 2001 and 2020, the country recorded over 370,000 deaths and 39,000 serious injuries from fire-related accidents. For business owners and facility managers, these statistics represent more than numbers—they represent potential financial catastrophe.

But fire alarm systems aren’t just a compliance requirement or safety measure. They’re a strategic business investment that delivers measurable returns. The question isn’t whether you can afford a modern fire alarm system—it’s whether you can afford not to have one.

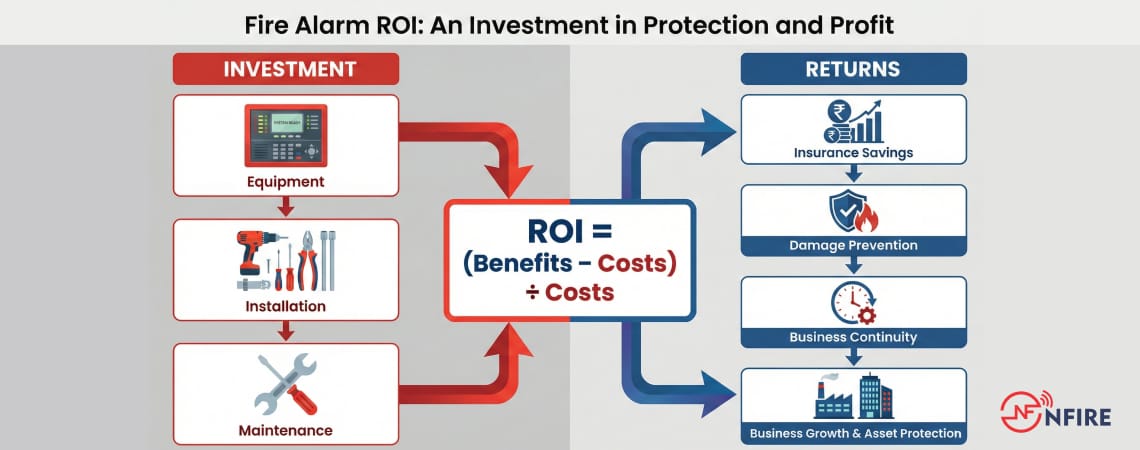

Fire alarm ROI (Return on Investment) measures the financial benefits gained from your fire alarm system compared to its total cost over time. Unlike a simple expense calculation, ROI analysis considers both the upfront investment and ongoing costs against quantifiable benefits including insurance savings, damage prevention, business continuity, and compliance value.

ROI (%) = [(Total Benefits – Total Costs) / Total Costs] × 100

A positive ROI indicates your fire alarm system generates more value than it costs. For example, an ROI of 150% means you receive ₹2.50 in benefits for every ₹1.00 invested.

The first step in calculating fire alarm ROI is understanding your complete initial investment. These costs vary significantly based on system type, building size, and complexity.

Conventional Systems: ₹1,50,000 – ₹3,50,000 for small buildings

Addressable Systems: ₹6,00,000 – ₹15,00,000 for medium facilities

Wireless Addressable Systems: ₹8,00,000 – ₹20,00,000+ for advanced implementations

AIoT-Enabled Systems: Premium pricing but with enhanced capabilities

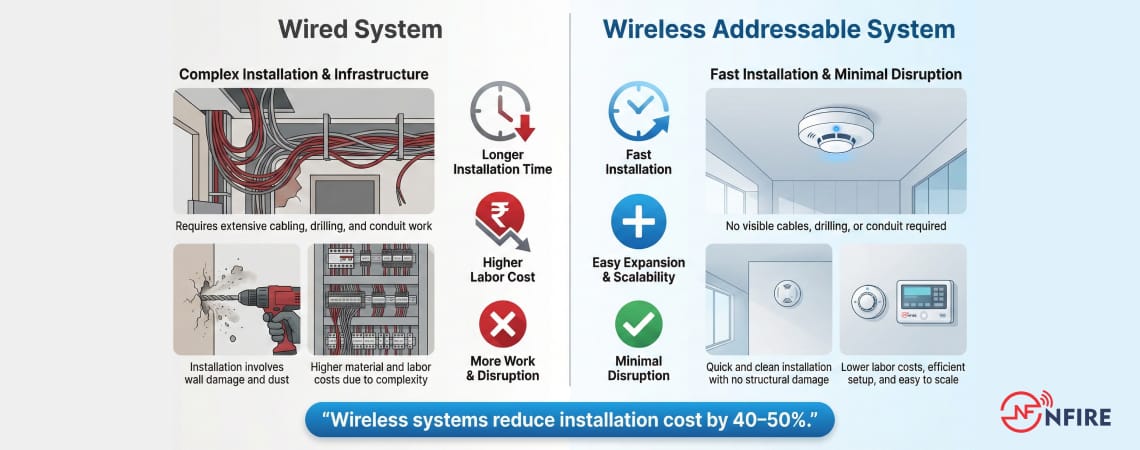

Installation represents a significant portion of total system cost—typically 40-60% of the project budget. However, wireless systems offer substantial advantages here.

Commercial fire alarm systems require regular maintenance to ensure reliability and

compliance. According to IS/ISO 7240 and NBC requirements, annual inspections are

mandatory

Small systems (up to 10,000 sq ft): ₹50,000 – ₹1,00,000 annually

Professional 24/7 monitoring services typically cost ₹2,000 – ₹8,000 per month (₹24,000 – ₹96,000 annually), depending on the number of zones and response requirements.

Budget ₹50,000 – ₹2,00,000 annually for battery replacements, sensor updates, and minor repairs. NFPA 72 standards recommend battery replacement according to manufacturer specifications or when recharged battery voltage falls below recommended levels

Plan for major upgrades every 10-15 years to maintain compliance and leverage new technology.

One of the most immediate and quantifiable benefits of a modern fire alarm system is reduced insurance premiums. Insurance companies recognize that monitored, addressable fire alarm systems significantly reduce their risk exposure.

Research from multiple markets shows that properties with NFPA-compliant monitored fire alarm systems typically secure 5-25% reductions in commercial property insurance premiums. In the Indian context, insurance companies commonly offer:

Basic fire alarm systems: 5-10% premium reduction

Monitored addressable systems: 10-15% premium reduction

Advanced systems with integration: 15-20% premium reduction

For a commercial property with ₹5 crore in insured assets and an annual premium of ₹5,00,000:

False alarms carry hidden costs that many business owners underestimate. According to UK research, false alarms cost businesses approximately £1 billion annually through disruption, with individual incidents costing ₹40,000 – ₹1,60,000 when accounting for:

Modern AIoT-powered fire alarm systems can reduce false alarms by up to 40% through intelligent detection algorithms that differentiate between real threats and harmless triggers like cooking smoke or steam. For a facility experiencing 10 false alarms annually, this represents potential savings of ₹1,60,000 – ₹6,40,000 per year.

This represents the largest potential benefit, though it’s harder to quantify since it depends on fire probability. However, the data is compelling:

If your facility has a 2% annual probability of fire (based on industry and location):

Fire incidents don’t just destroy property—they halt operations. Research indicates that fires cause downtime worth approximately £180 billion annually in manufacturing alone, with every minute of stalled production leading to lost revenue, increased labor costs, and supply chain penalties.

For a manufacturing facility generating ₹1 crore in monthly revenue:

Early detection and rapid response can reduce shutdown duration by 50-75%, representing substantial savings.

Investing in compliant systems avoids these costs and positions your facility for future regulations.

The National Building Code (NBC) 2025 mandates addressable fire alarm systems for commercial buildings. Non-compliance carries risks:

Properties with modern, NBC 2025-compliant fire safety systems command premium valuations and attract quality tenants willing to pay higher rents. This is particularly relevant for:

Wireless addressable and AIoT systems offer operational advantages that translate to cost savings:

While difficult to quantify precisely, employee confidence in safety systems affects:

The National Building Code (NBC) 2025 mandates addressable fire alarm systems for commercial buildings. Non-compliance carries risks:

Add all costs over your analysis period (typically 5-10 years)

Total Costs = Initial Equipment + Installation + (Annual Maintenance × Years) + (Annual Monitoring × Years) + Estimated

Total Costs = Initial Equipment + Installation + (Annual Maintenance × Years) + (Annual Monitoring × Years) + Estimated Repairs + Upgrade Reserves

Sum all quantifiable benefits over the same period:

Total Benefits = Insurance Savings + False Alarm Avoidance + Property Damage Prevention + Business Interruption Avoidance + Compliance Value + Efficiency Gains

ROI (%) = [(Total Benefits – Total Costs) / Total Costs] × 100

Payback Period (years) = Initial Investment / Annual Net Benefits

System Configuration: Wireless addressable system with 25 detectors, 5 zones, cloud monitoring

ROI = [(16,80,000 – 13,55,000) / 13,55,000] × 100 = 24%

Payback Period = 8,00,000 / 3,26,000 = 2.45 years

System Configuration: Advanced AIoT wireless addressable system with 120 detectors, multi-criteria sensors, integrated monitoring

Insurance savings (18% on ₹8,00,000 premium): ₹1,44,000 × 10 = ₹14,40,000

False alarm reduction (8 alarms avoided × ₹1,00,000): ₹8,00,000 × 10 = ₹80,00,000

Production downtime prevention (1 incident avoided): ₹35,00,000

Property damage prevention: ₹40,00,000

Compliance and efficiency gains: ₹15,00,000

Total 10-year benefits: ₹1,84,40,000

ROI = [(1,84,40,000 – 87,20,000) / 87,20,000] × 100 = 111%

Payback Period = 45,00,000 / 9,72,000 = 4.6 years

System Configuration: Comprehensive wireless addressable system with AIoT analytics, voice evacuation, 300+ detection points

ROI = [(4,00,00,000 – 1,57,00,000) / 1,57,00,000] × 100 = 155%

Payback Period = 75,00,000 / 24,30,000 = 3.1 years

These systems offer superior ROI compared to conventional or wired addressable systems because:

Systems with artificial intelligence and IoT integration deliver:

An oversized system wastes money on unnecessary equipment, while an undersized system creates coverage gaps. Work with certified fire safety professionals to:

Systems compliant with IS/ISO 7240 and EN54 standards offer better ROI through:

Professional 24/7 monitoring adds ongoing costs but delivers significant ROI through:

Regular maintenance maximizes ROI by:

Research shows that proper maintenance can reduce false alarms by 25% and extend system life by 3-5 years.

When presenting fire alarm ROI to decision-makers, follow these strategies

Start with the potential cost of not investing

Use conservative estimates for benefits to maintain credibility. It’s better to under-promise and over-deliver. If false alarm reduction could save ₹10 lakhs, present ₹6-7 lakhs in your ROI calculation.

Present best-case, realistic, and worst-case scenarios to demonstrate that ROI remains positive across different assumptions.

While ROI focuses on financial returns, don’t ignore

Show that modern wireless addressable AIoT systems offer superior ROI compared to:

Modern wireless addressable fire alarm systems with AIoT capabilities offer distinct ROI advantages that deserve special attention

Installation typically represents 40-60% of traditional wired system costs. Wireless systems dramatically reduce this:

For a medium-sized facility, this can translate to ₹10-15 lakhs in immediate savings

AIoT systems use machine learning to distinguish between real fires and false triggers. This technology analyzes multiple parameters simultaneously:

The documented 40% reduction in false alarms delivers substantial ongoing savings. For a facility experiencing 10 false alarms annually at ₹1,00,000 per incident, this means ₹4,00,000 in annual savings.

AIoT systems monitor their own health and predict component failures before they occur. This shifts maintenance from reactive (expensive) to proactive (cost-effective):

Wireless addressable systems with AIoT capabilities integrate seamlessly with:

This integration creates additional value through:

Wireless systems offer unmatched scalability:

This flexibility protects your investment and reduces future upgrade costs

Calculating fire alarm ROI isn’t just about justifying an expense—it’s about recognizing a strategic investment that protects your most valuable assets: people, property, and business continuity.

The data is clear: modern wireless addressable fire alarm systems with AIoT capabilities deliver measurable returns through:

As India moves toward NBC 2025 compliance and businesses face increasing pressure to demonstrate responsible safety practices, the question isn’t whether to invest in modern fire safety—it’s how quickly you can implement systems that protect lives, preserve assets, and deliver bottom-line value.

A positive ROI over 10 years indicates good value. Most modern wireless addressable systems deliver ROI of 50-150%, with payback periods of 2-5 years. Systems with higher upfront costs but superior false alarm reduction and integration capabilities often deliver better long-term returns.

Payback periods typically range from 2-5 years, depending on system type, insurance savings, false alarm frequency, and operational factors. Facilities with higher false alarm rates or more substantial insurance savings achieve faster payback.

Yes. While specific discounts vary by insurer and policy type, systems compliant with IS/ISO 7240 standards with professional monitoring typically qualify for 10-15% premium reductions, with advanced systems receiving up to 20% discounts.

For most applications, yes. While wireless systems may have slightly higher equipment costs, they reduce installation expenses by 40-50%, minimize building disruption, and offer easier expansion. Over a 10-year period, total cost of ownership is typically 20-30% lower.

Use a risk-based approach: (Annual probability of fire) × (Potential damage) × (Damage reduction from early detection). For example, if you have a 2% annual fire probability, ₹1 crore potential damage, and 65% damage reduction from early detection, the annual value is ₹1.3 lakhs.

The top ROI drivers are: (1) Insurance premium reductions, (2) False alarm minimization through AIoT technology, (3) Proper system design matching facility risks, (4) Professional 24/7 monitoring, (5) Regular maintenance, and (6) Integration with other building systems.

For the formal ROI percentage, focus on quantifiable financial benefits. However, present non-financial benefits (employee safety, compliance, reputation) separately as they strengthen the overall business case even though they’re difficult to monetize.

NBC 2025 makes addressable systems mandatory for commercial buildings. Investing now in compliant technology avoids future retrofit costs, ensures uninterrupted operations, and positions your facility ahead of enforcement deadlines. The compliance value alone can justify 15-25% of system investment.

Contact NFire Solutions to discuss how wireless addressable and AIoT-enabled fire alarm systems can protect your business while delivering measurable financial returns.